CUET-UG | Accountancy QBank

Welcome Learners !!

ScholarWorm welcomes all of his Aspirants who are dreaming to achieve their desired career goal in life.

Here we present you the Questions from the subject of Accountancy for your CUET-UG (Common University Entrance Test). Keep Solving questions to prepare better and improve your scores.

Instructions for Question Paper :-

1. The Test Paper is AI generated.

2.The AI bot creates a set of 20 Questions from the pool of questions that is being updated regularly by our expert faculties.

3. Only 1 SET is available per User per Day in free Question Banks. Come Back tomorrow for New SET.

Note :- Number of Questions and Timer is not customizable in Free QBanks.

#1. Bishan and Sudha were partners in a firm sharing profits and losses in the ratio of 5 : 3. Alena was admitted as a new partner. It was decided that the new profit sharing ratio of Bishan, Sudha and Alena will be 10 : 6 : 5. The sacrificing ratio of Bishan and Sudha will be

#2. Income and Expenditure Account records :

#3. Pick the odd one out :

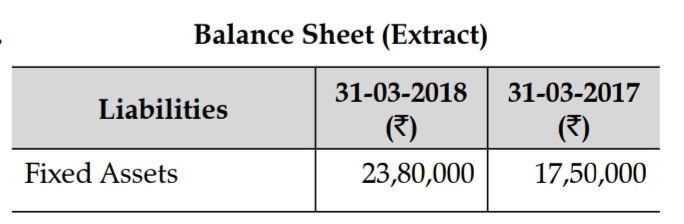

#4. Depreciation on fixed assets was ` 2,00,000 for the year. How much amount for ‘Purchase of fixed assets’ will be shown in investing activity for cash flow statement prepared on 31st March, 2018 ?

#5. Which of the following is not an activity ratio ?

#6. Which of the following is not a part of Finance Cost (in Statement of Profit and Loss) ?

#7. Pick the odd one out

#8. Current ratio of Vidur Pvt. Ltd. is 3 : 2. Accountant wants to maintain it at 2 : 1. Following options are available : [ (i) He can repay bills payable (ii) He can purchase goods on credit (iii) He can take short-term loan. ] Choose the correct option :

#9. Subscription of shares should not be less than_________ % of the issued shares.

#10. Balance in Share Forfeiture Account is shown in the balance sheet under the head of :

#11. At the time of issue of debentures, Debentures Account is :

#12. Jaipur Club has a prize fund of ` 6,00,000. It incurs expenses on prizes amounting to ` 5,20,000. The expenses should be :

#13. Pick the odd one out

#14. The account which is prepared on dissolution of a partnership firm :

#15. Pick the odd one out:

#16. HR Limited issued 10,000 equity shares @ ` 10 each at 10% premium. All shares were subscribed and amount was received. Identity the amount to be transferred to Securities Premium Reserve A/c.

#17. Debenture interest is paid as :

#18. Pick the odd one out :

#19. Which of the following items is not dealt through Profit and Loss Appropriation Account ?

#20. Payment of income tax is classified under :

Finish